2024 Form 1040 Schedule 7 5 1 – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . While California is often synonymous with Hollywood glamour and beautiful coastlines, it’s also a hub for businesses across various industries. The state plays a vital role in America’s overall GDP. .

2024 Form 1040 Schedule 7 5 1

Source : www.irs.govWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2024 Form 1040 ES

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS unveils new tax brackets, standard deduction for 2024 tax year

Source : www.syracuse.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govNew Hampshire tax filers have a new filing option, directly from

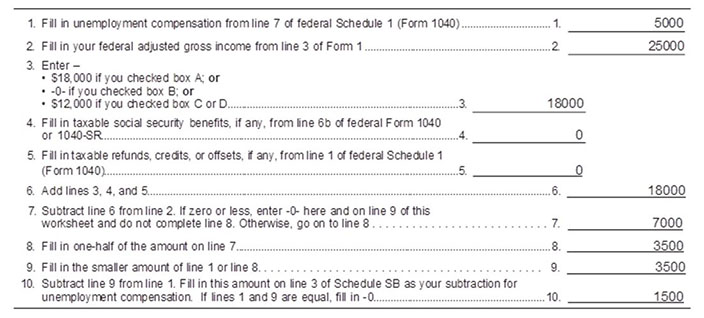

Source : newhampshirebulletin.comDOR Unemployment Compensation

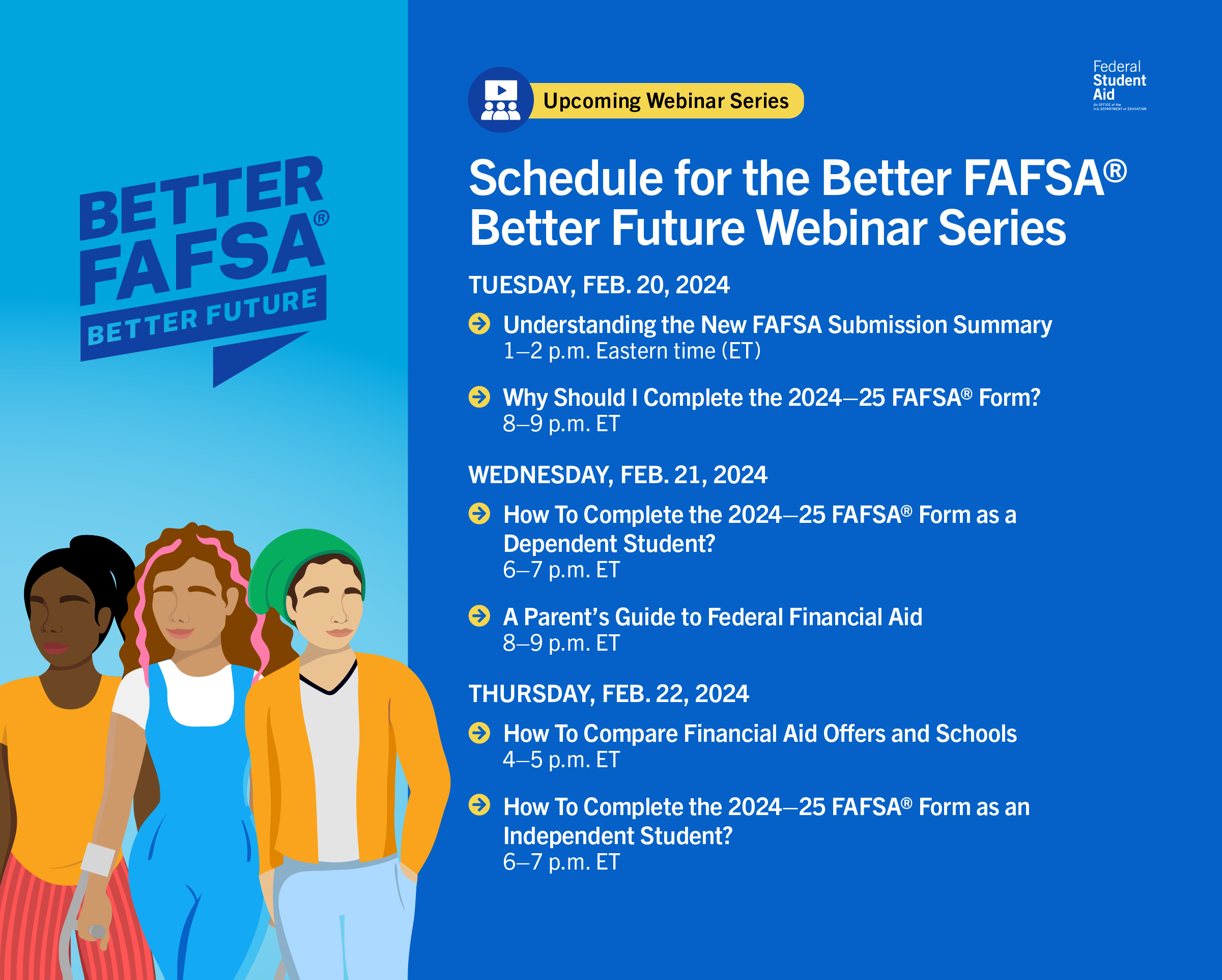

Source : www.revenue.wi.govFederal Student Aid (@FAFSA) / X

Source : twitter.com2024 Form 1040 Schedule 7 5 1 1040 (2023) | Internal Revenue Service: Keep reading to find out everything you should know about Form 1040 for tax year 2022. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from 5.83% to 6.83%. . Margin loan rates from 5.83% to 6.83%. A change impacting 2019 These are claimed on your Form 1040, Schedule 1 as above-the-line deductions. Under President Donald Trump’s tax reform, the .

]]>